Saves Taxes when it comes to managing our finances, one aspect that everyone is keen on optimizing is taxation. In India, saving taxes is not just a financial strategy; it’s practically a national sport! If you’re looking for ways to minimize your tax liability and make the most of your hard-earned money, you’re in the right place. In this comprehensive guide, we’ll explore seven great ways to save taxes on your current salary in India. So, let’s dive in and unravel the secrets to a more tax-efficient financial plan.

Table of Contents

Save Taxes By – Understanding the Basics of Income Tax

Before delving into specific strategies, it’s crucial to grasp the fundamentals of income tax in India. The income tax you pay depends on various factors, including your salary, investments, and deductions. It’s essential to categorize your income into different heads, such as salary income, house property income, business or profession income, and more. Understanding these basics will pave the way for a more informed approach to tax planning.

Utilize Section 80C to the Fullest

Section 80C of the Income Tax Act is a powerful tool for tax-saving, offering deductions of up to Rs. 1.5 lakh. By investing in specified instruments, such as Equity-Linked Saving Schemes (ELSS), Public Provident Fund (PPF), and National Savings Certificate (NSC), you can not only secure your financial future but also reduce your taxable income significantly.

For instance, if your annual salary is Rs. 8 lakh and you invest Rs. 1.5 lakh in eligible instruments under Section 80C, your taxable income effectively becomes Rs. 6.5 lakh. This can lead to substantial tax savings, especially in higher tax brackets.

Optimize Home Loan Benefits

If you’ve taken a home loan to realize your dream of owning a house, you’re entitled to certain tax benefits. Under Section 24(b), you can claim deductions on the interest paid on the home loan, up to Rs. 2 lakh for a self-occupied property. Additionally, Section 80C allows you to claim deductions on the principal repayment, which can further reduce your taxable income.

Consider this scenario: You have an outstanding home loan with an annual interest payment of Rs. 3 lakh. By leveraging the benefits provided by Section 24(b), you can save Rs. 60,000 (assuming you fall in the 20% tax bracket). This not only eases your financial burden but also makes homeownership a more tax-efficient investment.

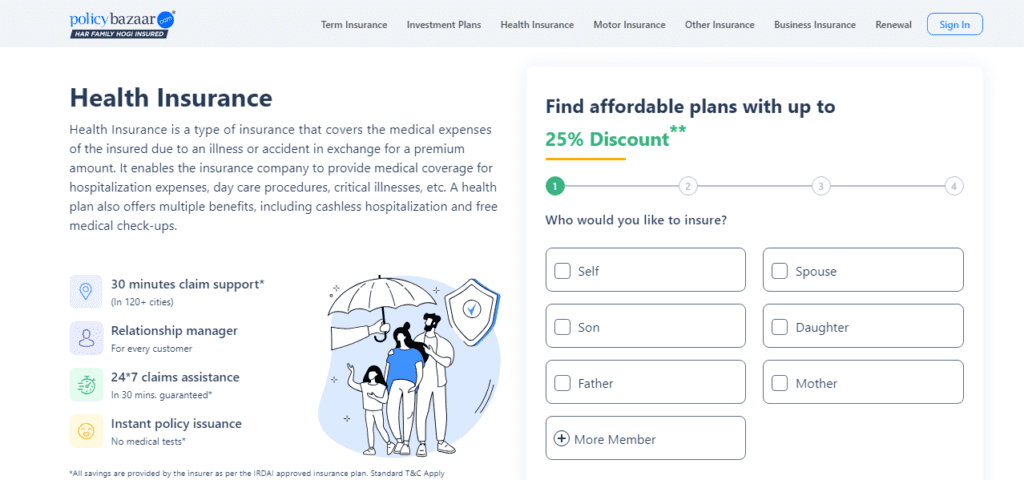

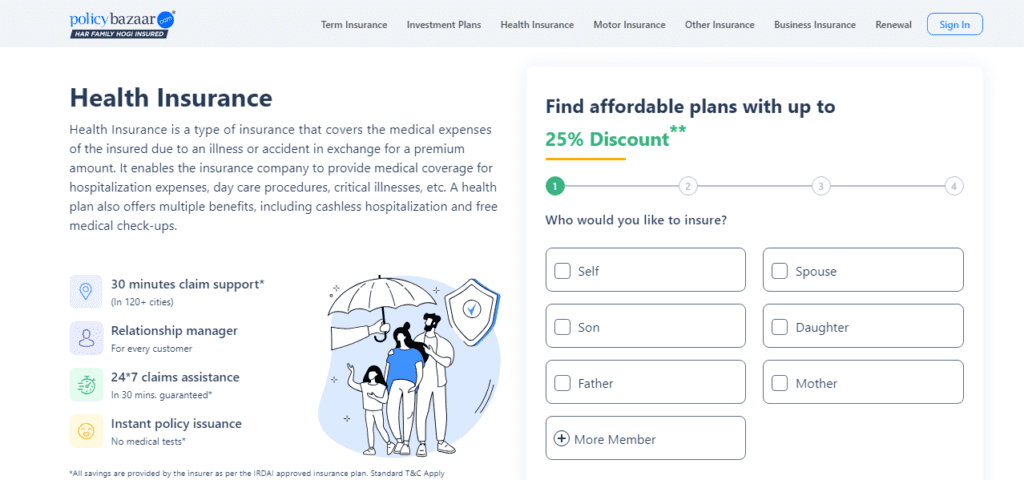

Leverage Health Insurance Premiums under Section 80D

Securing your health is paramount, and the government incentivizes this by offering tax deductions on health insurance premiums. Under Section 80D, you can claim deductions for premiums paid for yourself, your family, and even your parents. For individuals below 60 years, the maximum deduction is Rs. 25,000, which increases to Rs. 50,000 if you’re paying for your parents’ health insurance.

Let’s say you’re paying an annual health insurance premium of Rs. 20,000 for yourself and Rs. 30,000 for your parents. By utilizing the benefits of Section 80D, you can save Rs. 7,000 in taxes (considering a 20% tax bracket). This not only protects your health but also provides a tax shield for your income.

Explore NPS for Additional Deductions

The National Pension System (NPS) is a retirement-focused investment avenue that not only helps you build a corpus for your golden years but also offers attractive tax benefits. Under Section 80CCD(1B), you can claim an additional deduction of up to Rs. 50,000 over and above the limit of Section 80C.

Assume your annual income is Rs. 10 lakh, and you contribute Rs. 50,000 to your NPS account. By doing so, you not only secure your retirement but also reduce your taxable income to Rs. 9.5 lakh. This can lead to substantial tax savings, making NPS an excellent choice for long-term tax planning.

Maximize HRA Exemptions

For individuals living in rented accommodations, the House Rent Allowance (HRA) is a significant component of their salary. By optimizing HRA exemptions, you can reduce your taxable income, thereby saving on taxes.

Let’s say your monthly rent is Rs. 15,000, and your HRA is Rs. 20,000 per month. By providing rent receipts and other necessary documents to your employer, you can claim exemptions on your HRA. Assuming you fall in the 20% tax bracket, this can result in annual tax savings of Rs. 24,000.

Stay Informed about the Latest Tax Rebates and Deductions

The landscape of taxation is dynamic, with the government introducing new rebates and deductions to promote specific activities. It’s crucial to stay informed about these changes and leverage them to your advantage.

For example, the government might introduce a tax rebate for electric vehicle purchases or additional deductions for contributions to specific charitable organizations. By staying updated and aligning your financial decisions with the latest tax provisions, you can maximize your tax savings and create a more robust financial plan.

Conclusion

In the complex world of income tax, saving money requires a combination of strategic planning and informed decision-making. By understanding the basics of income tax, utilizing key sections like 80C, optimizing home loan benefits, leveraging health insurance premiums, exploring NPS, maximizing HRA exemptions, and staying informed about the latest tax rebates, you can pave the way for a more tax-efficient financial future.

Remember, the key to effective tax planning is not just about saving money but also about making your hard-earned income work for you. So, take charge of your financial destiny, explore these avenues, and let your money do more for you.

Disclaimer

The information provided in this blog post is intended for general informational purposes only and should not be considered as professional financial or tax advice. Tax laws and regulations are subject to change, and individual circumstances may vary. It is advisable to consult with a qualified tax professional or financial advisor to assess your specific situation and obtain personalized advice. The author and the platform do not assume any responsibility for actions taken based on the information provided in this blog post. Always verify the latest tax regulations and seek professional guidance for accurate and current advice tailored to your individual needs.