Navigating the world of investment options often leads to the comparison between Mutual Funds and Exchange-Traded Funds (ETFs). Both offer avenues for diversification and growth, yet they diverge in their structures, trading mechanisms, and overall appeal to investors.

Understanding these distinctions is pivotal for informed investment decisions. This guide explores four fundamental aspects, shedding light on the nuances between Mutual Funds and ETFs, aiding in discerning which aligns better with specific financial goals and risk tolerances.

Table of Contents

1) Mutual Funds and ETFs – Understanding Basics

What Are Mutual Funds?

Mutual funds are investment pools where money from numerous investors is collected and managed by professional portfolio managers. These managers strategically invest the pooled money across a diversified portfolio comprising stocks, bonds, or other securities.

Key Features and Benefits of Mutual Funds

Diversification: Through a single investment, mutual funds offer exposure to various assets, spreading risk across a broad spectrum.

Professional Management: Skilled fund managers conduct extensive research and make investment decisions based on their expertise.

Liquidity and Accessibility: Investors can buy or sell mutual fund shares based on the fund’s Net Asset Value (NAV) at the market’s closing, ensuring accessibility and ease of transactions.

Range of Options: Mutual funds cater to different investment goals, whether seeking growth, income, or a balanced approach.

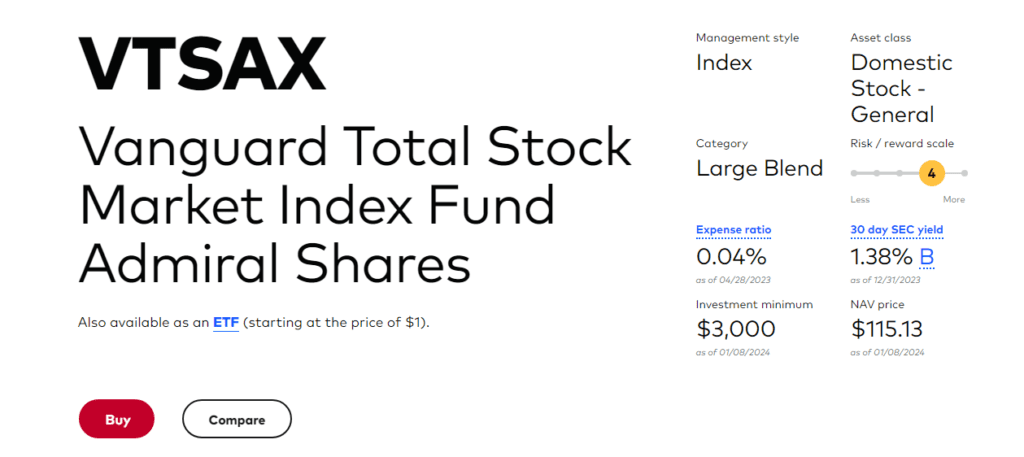

Example: Vanguard Total Stock Market Index Fund (VTSAX)

This fund aims to track the performance of the CRSP US Total Market Index, providing investors exposure to the entire U.S. stock market. It holds a wide array of stocks across various sectors and market capitalizations, offering diversification within a single investment. With low expense ratios and a passive management approach, VTSAX remains a popular choice for investors seeking broad market exposure at a relatively low cost.

2) Exploring Exchange-Traded Funds (ETFs)

What Are ETFs?

Exchange-Traded Funds (ETFs) share similarities with mutual funds, comprising a collection of securities like stocks, bonds, or commodities. However, ETFs trade on stock exchanges throughout the trading day, offering flexibility in buying and selling.

Key Features and Benefits of ETFs

- Intraday Trading: ETFs trade like individual stocks, allowing investors to buy or sell shares at market prices during market hours.

- Lower Expense Ratios: Typically, ETFs have lower fees compared to mutual funds, contributing to cost efficiency for investors.

- Transparency and Tax Efficiency: ETFs disclose their holdings daily, providing transparency to investors. Additionally, their unique structure often leads to greater tax efficiency compared to mutual funds.

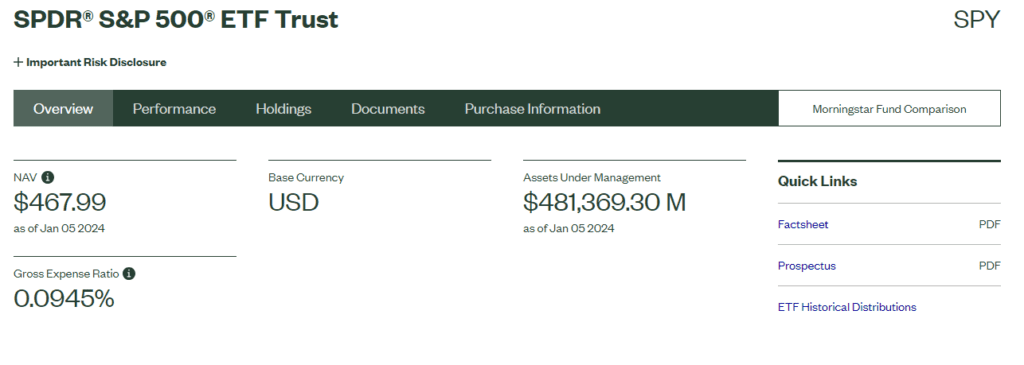

Example: SPDR S&P 500 ETF Trust (SPY)

https://www.spglobal.com/spdji/en/indices/equity/sp-500/#overview

This ETF aims to mimic the performance of the S&P 500 index, which represents 500 of the largest publicly traded companies in the United States. SPY allows investors to gain exposure to the overall U.S. stock market by holding a portfolio that closely mirrors the S&P 500 index composition. As an ETF, SPY trades on major stock exchanges like a single stock, offering liquidity and flexibility to investors who can buy and sell shares throughout the trading day at market prices.

3) Key Differences Between Mutual Funds and ETFs

Structure and Trading

- Mutual Funds: Transactions occur at the end-of-day NAV, traded directly with the fund company.

- ETFs: Traded like stocks on exchanges, allowing investors to buy or sell throughout the trading day at market prices.

Cost and Expenses

- Mutual Funds: Often have higher expense ratios due to management fees and sales charges (loads).

- ETFs: Generally boast lower expense ratios and fewer sales charges, contributing to cost savings for investors.

Tax Efficiency

- Mutual Funds: Frequent trading within mutual funds can lead to capital gains distributions, potentially resulting in tax implications for investors.

- ETFs: Their unique creation/redemption process and lower turnover can offer tax advantages, making them more tax-efficient in many cases.

4) Making the Right Choice for Your Portfolio

Consider Your Investment Goals and Strategy

- Risk Tolerance: Understand your comfort level with risk; some funds might be riskier than others.

- Time Horizon: Evaluate your investment time frame—short-term, mid-term, or long-term goals.

- Diversification Needs: Assess whether you need broad exposure to various asset classes or specific sectors.

Creating a Balanced Portfolio

- Blend of Both: Some investors opt for a combination of mutual funds and ETFs to diversify their portfolios.

- Asset Allocation: Determine the ideal mix of stocks, bonds, and other assets that align with your investment objectives and risk tolerance.

Conclusion:

Mutual funds and ETFs present compelling investment opportunities, each with its unique advantages catering to different investor preferences. Understanding their nuances, aligning them with your financial goals, and considering your risk appetite are key steps toward making informed investment decisions.

Your choice between mutual funds and ETFs—or a combination of both—can significantly impact your portfolio’s performance and your overall investment journey.

Whether you prefer the hands-on approach of ETFs or the professional management of mutual funds, these investment vehicles can play pivotal roles in achieving your financial aspirations.

Thank you for taking the time to explore the world of mutual funds and ETFs with us! Your thoughts and questions are valuable, and we invite you to share them in the comments section below.